Negative EV, 8% Dividend, Sale Likely

Forced Selling Drives Price Far Below Intrinsic Value

Today’s Stock:

Trading below net cash + securities

8% Dividend

Shareholder friendly management team

Sale or liquidation likely within next year

Sometimes the market pushes a stock far below its true value for reasons that have nothing to do with the business itself.

Sometimes investors are forced to sell, not because the business is weak, but because rules or restrictions leave them no choice.

These situations often create some of the most interesting setups in the market. Not because the business is broken, but because the selling is mechanical rather than analytical.

For patient investors willing to look past the headline and focus on assets, incentives, and long-term outcomes, forced selling can open the door to opportunities the market is temporarily ignoring.

Let’s take a look…

Disclaimer: The information provided in this article is for informational purposes only and should not be considered investment advice. Investing involves risk, including the potential loss of principal. The author may own, or plan to purchase, shares in the security discussed. The author is not a registered investment advisor and does not provide personalized investment advice. Always conduct your own research and consider your investment objectives and risk tolerance before making any investment decisions. The author and publisher shall not be liable for any actions taken based on the information provided in this article.

Overview:

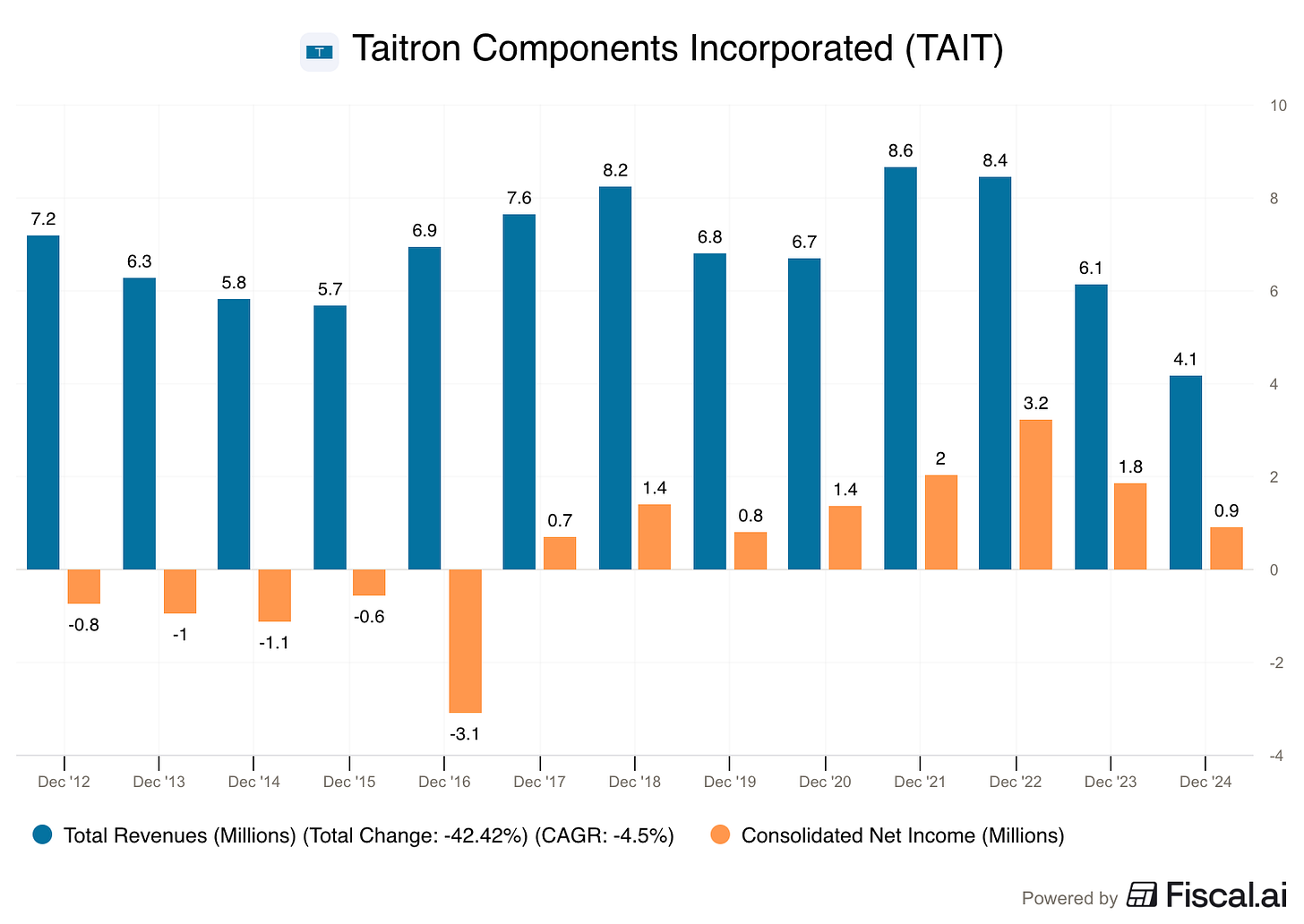

Taitron Components (TAIT) is a niche electronic components distributor serving manufacturers of electronic equipment. Historically, the company branded itself as a “components superstore,” stocking thousands of semiconductor and optoelectronic components.

In addition to distribution, Taitron operates an original design manufacturing (ODM) segment. In this business, Taitron designs, engineers, and sources custom electronic components tailored to specific customer applications. These products are typically embedded into customers’ end products and sold under multi‑year supply arrangements. Examples include timers and motor controllers for agricultural and animal‑feeding equipment, battery chargers, and LED modules used in swimming pools, fountains, and specialty lighting applications.

Taitron was founded in 1989 and went public via an IPO in 1995, giving it nearly 35 years of operating history and roughly three decades as a public company. The business is headquartered in California, with sourcing, engineering, and supplier relationships primarily based in China and Taiwan.

Throughout its history, Taitron has been run conservatively. The company has generated a profit in each of the past eight years, carries no debt, and has historically returned approximately 50% of earnings to shareholders through dividends. Capital allocation has emphasized cash returns rather than aggressive expansion or acquisition‑driven growth.

2025 Sell-Off

In 2025, Taitron’s stock declined sharply, falling from over $2.50 to $1.00 per share. The decline was driven by three developments:

Tariffs crushed the operating business. Since nearly all of Taitron’s components are sourced from China, tariffs directly increased product costs. Demand for Taitron’s products weakened, as customers delayed purchases or sought alternatives.As a result, revenue fell roughly 50% in Q3, and the company reported its largest operating loss in over five years.

Dividend reduction. Management cut the quarterly dividend by 30%, from $0.05 to $0.035 per share.

Nasdaq delisting. Management announced a voluntary delisting from the Nasdaq exchange in order to reduce ongoing public company costs.

While tariffs represent a fundamental challenge to the business, the dividend cut and Nasdaq delisting likely triggered significant forced selling. Many institutions are restricted from owning OTC‑traded securities, which likely amplified the stock’s decline beyond what operating results alone would justify.

Valuation

Despite near‑term operational challenges, Taitron’s balance sheet provides a substantial margin of safety:

Market capitalization: $9.3M

Net cash: ~$4M

Investments: ~$6M

Although the company does not disclose details of its investment portfolio, it states that the holdings consist of equity securities of public companies. Notably, the investment portfolio has generated returns that exceeded operating income in each of the past two years.

With cash and investments alone exceeding the company’s current market cap, Taitron can be viewed as an investment holding company with an electronic distribution business attached.

In addition, the company owns three properties:

1. Valencia, California (Headquarters & Distribution Facility)

A ~50,000 sq. ft. building consisting of approximately 40,000 sq. ft. of warehouse space and 10,000 sq. ft. of office space.

The property’s assessed tax value is $5.6M, however this understates the true market value as Calfironia property tax assessments are subject to capped annual increases.

Recent comparable sales are in the range of $250-300 per square foot, which implies an estimated market value of $14M.

2. Shanghai, China (Engineering Office)

4,500 sq. ft. of office space purchased in 2006 for ~$1.2M. A conservative estimate places current value at ~$2M.

3. Taipei, Taiwan (Office Space)

2,500 sq. ft. of office space purchased in 1998 for ~$500k. A conservative estimate places current value at ~$1.5M.

Combined, these properties are worth approximately $17M.

Even ignoring the value of inventory and receivables, Taitron’s estimated liquidation value is roughly $27M versus a market capitalization of $9.3M, implying the stock trades at a 66% discount to liquidation value.

Sale or Wind-Down Likely

CEO Stuart Wang is 75 years old, has served as the CEO of Taitron since their founding in 1989, and holds ~23% of shares outstanding and ~65% of total voting power through Class B Shares.

The Co-founder of Taitron Tzu Sheng Ku has is also 75 years old and owns another ~20% of the company.

It is worth noting that Mr. Wang has served shareholders well during his tenure as CEO. He has paid himself a reasonable salary of $195,000 per year while paying out over $9M in dividends since 2016.

Given his substantial ownership stake, the majority of his yearly earnings come from dividends rather than his salary. This aligns him nicely with majority shareholders and gives me confidence he will choose to maximize value for shareholders.

In June 2025, the company undertook a major restructuring, including:

A 30% reduction in base salaries for all employees

A 30% reduction in quarterly dividends

Prepayment of pension obligations and severance benefits

This restructuring followed tariff announcements in March 2025 and appears consistent with a company preparing for either a sale or an orderly wind‑down. With both founders at retirement age, an existential tariff‑driven threat to the business, and no obvious succession plan, I believe there is a meaningful probability of a sale or liquidation within the next several years.

In such a scenario, shareholders could potentially realize value closer to the estimated $27M liquidation figure versus today’s $9.3M market capitalization. A strategic buyer could assign additional value to Taitron’s inventory and long‑standing customer relationships.

At $1.68 per share, Taitron offers a large margin of safety. Either operating conditions normalize over time, or management elects to monetize the company’s asset base, with both outcomes offering attractive upside relative to the current price.

Risks:

The biggest risk here is that the CEO has voting control of the company, and therefore has authority over the company’s strategic direction.

While he has a long history of serving shareholders well, there is a risk that he continues operating the business at a loss for an extended period, which would gradually erode liquidation value.

Additionally, in a wind‑down scenario, asset sales could take longer than expected or occur at prices below conservative estimates, particularly for foreign real estate holdings.

Disc. Long shares of TAIT

Disclaimer: The information provided in this article is for informational purposes only and should not be considered investment advice. Investing involves risk, including the potential loss of principal. The author may own, or plan to purchase, shares in the security discussed. The author is not a registered investment advisor and does not provide personalized investment advice. Always conduct your own research and consider your investment objectives and risk tolerance before making any investment decisions. The author and publisher shall not be liable for any actions taken based on the information provided in this article.

It’s up 40% in the past month so the market is starting to catch up

Interesting idea. Is there any other indication that they may be thinking of selling?